- Planet and Profit's Newsletter

- Posts

- Voluntary Carbon Market: Insights and Trends ♻️

Voluntary Carbon Market: Insights and Trends ♻️

Transaction volumes, price trends, media scrutiny and much more...

Hey Ekofolks,

This week, we're diving deep into the voluntary carbon market, exploring the intricacies of the carbon life cycle, and unveiling a treasure map featuring all carbon projects registered since 2002.

🌱 Voluntary Carbon Market

🌍 SSS

🚀 Cleantech Funding

🗺️ VCM Map

♻️ Carbon Cycle

There's plenty to uncover, so fasten your seatbelt and let's embark on a journey to become carbon-wise! 🌍🌱

Key Findings from the 2023 Voluntary Carbon Market 🌱

The voluntary carbon market (VCM) saw notable changes in 2023. Here are the key highlights:

📉 Continued Contraction: Transaction volumes dropped 56%, with the total value at $723M, a 61% decline.

💲 Price Trends: Average price per ton CO2e was $6.53, slightly down from 2022, but rebounding in early 2024.

📰 Media Scrutiny: Negative press on carbon credit projects led to a pullback in investments and increased complexity for developers.

💡 New Initiatives: ICVCM’s Core Carbon Principles and VCMI’s Claims Code boosted confidence, but delays and lack of guidance kept buyers cautious.

🔍 Market Bifurcation: Split between buyers seeking pure carbon removal and those looking for co-benefits. Supply of co-benefit credits grew, but premiums declined.

📊 Credit Category Trends: Forestry and Land Use, and Renewable Energy credits saw big declines. Energy Efficiency, Agriculture, and Household Device categories grew.

🌱 Regional Shifts: Pullback from REDD+ projects affected Asia, Latin America, and the Caribbean, with buyers preferring projects closer to home.

To access the full report, please click on the link below:

Credit to Ecosystem Marketplace (EM) for the annual State of the Voluntary Carbon Market (SOVCM) report—a comprehensive overview of global voluntary carbon credits since 2005. 🌐📈

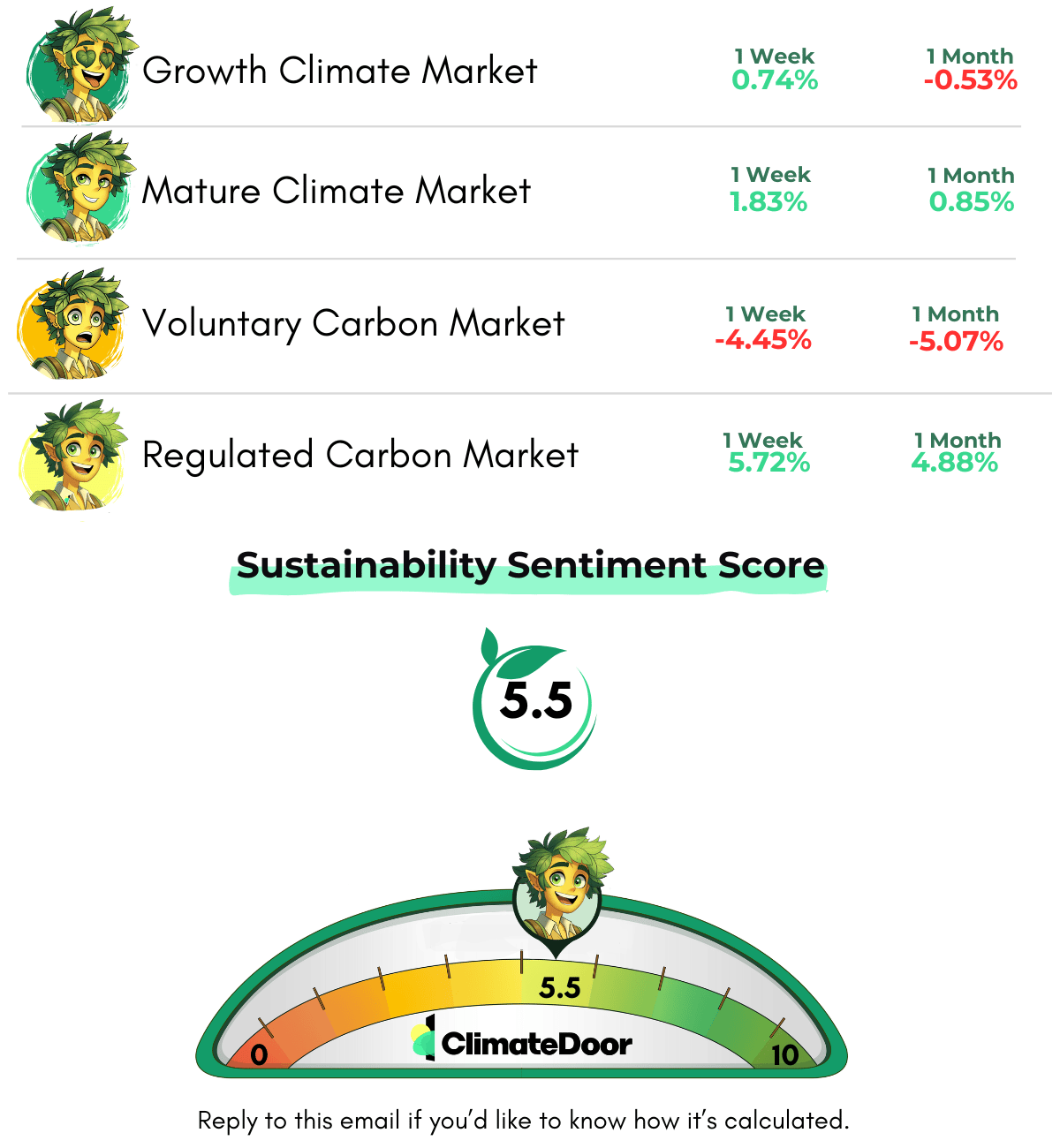

The SSS is sitting midrange this week. Our Growth Climate and Mature Climate markets both experienced climbs on July 3, however the Mature Climate, in particular, took an impressive jump. The new quarter also saw the Regulated Carbon markets take a welcomed up-tick. Hopefully, Q3 will continue to be kind to our indexes!

The Voluntary Carbon market, however, is seeing fluctuations and facing difficulties, as usual. The Climate Action Reserve (CAR) is facing criticism for missing additionality failures in over 400,000 landfill gas credits. According to analysis by a non-profit organization, half of the landfill gas credits issued by CAR likely do not meet additionality tests. "Additionality" ensures that carbon credits represent genuine, additional reductions in greenhouse gas emissions that wouldn't have occurred without the carbon credit project.

Reports of this issue are raising alarms because the Integrity Council for the Voluntary Carbon Market (ICVCM) had approved the related methodology for its Core Carbon Principle (CCP) integrity stamp. Suggesting that many of these credits do not meet this criterion raises questions about their legitimacy and the effectiveness of the ICVCM's approval process.

Top 17 Cleantech Funding Opportunities in Canada 🚀

Are you looking for funding opportunities to advance your cleantech projects in Canada?

Here’s a list of federal programs that can help you achieve your goals in climate and clean energy sectors. From tax deductions to grants and loans, these programs support various initiatives aimed at reducing greenhouse gas emissions and promoting sustainable technologies.

For further details on cleantech funding opportunities, reach out to the ClimateDoor team, and they will assist you in navigating and applying for government funding.

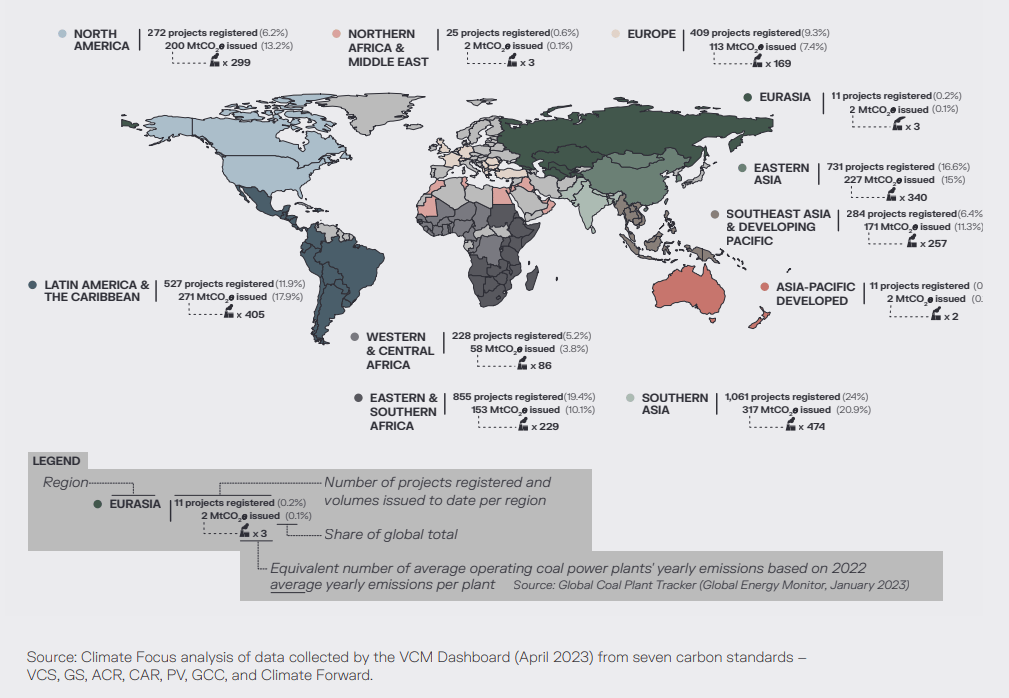

Mapped: VCM credits issued and projects registered since 2002 🗺️

The carbon credit supply mainly stems from projects in low- and middle-income countries. Europe and North America account for 189.6 MtCO2e issuances, while the rest of the world makes up 1,113.7 MtCO2e.

The top suppliers are India, China, Brazil, the United States, and Indonesia.

Here's the regional breakdown:

Southern Asia: Leading in renewable energy carbon credits.

Latin America and the Caribbean: Top supplier of nature-based solutions.

Africa: Dominates in energy efficiency carbon credits.

Europe and North America: Lead in coal mine methane, industrial gases, and carbon capture and storage projects.

Interestingly, the distribution of issuances doesn't always match the distribution of projects. For instance, Southern, Eastern, and Central Africa rank second in project numbers but sixth in issuance volume.

Latin America and the Caribbean are fourth in project numbers but second in issuance volume. Southern Asia leads globally with the most projects and the highest issuance volume.

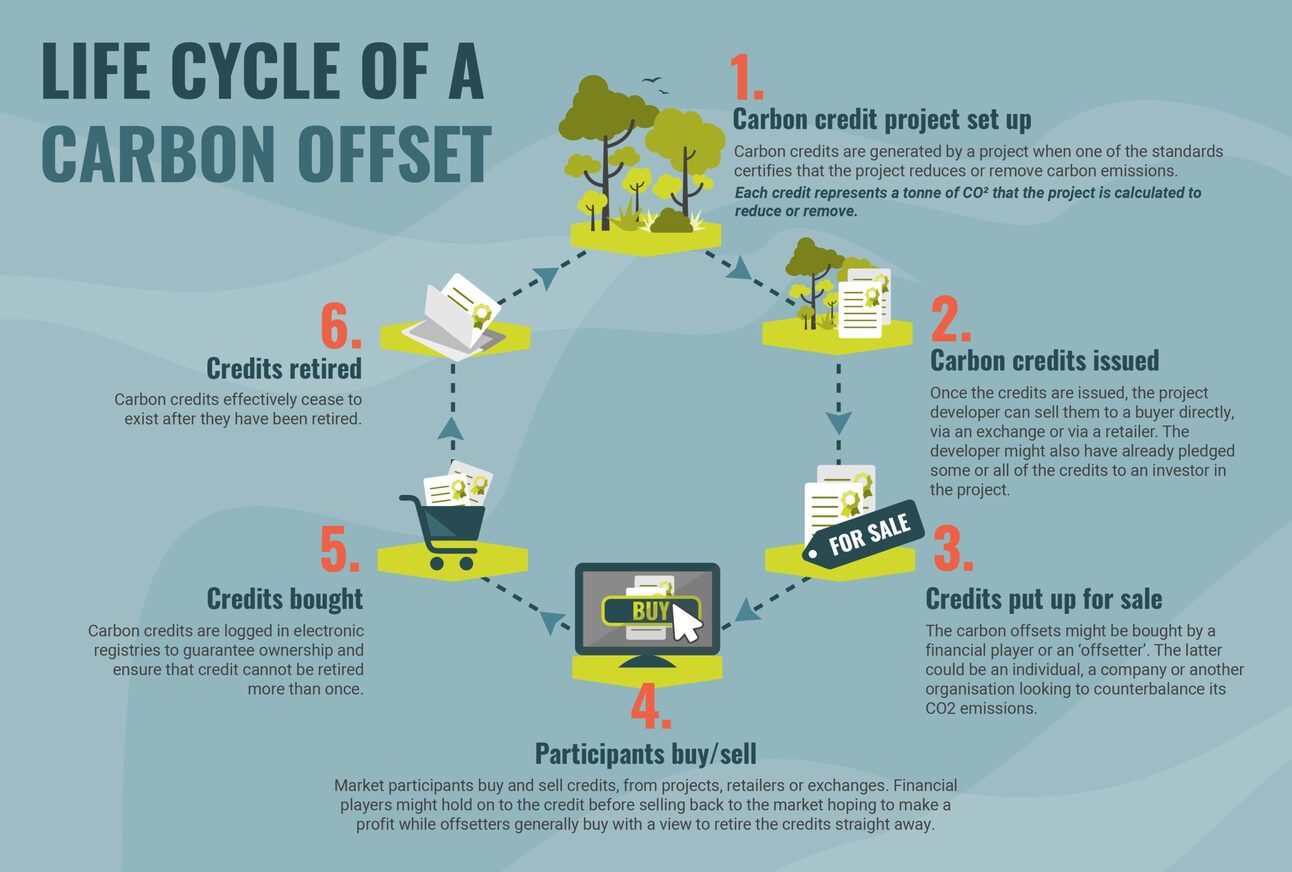

Life Cycle of a Carbon Credit♻️

THOUGHTS ON TODAY’S ISSUE?

🌿 Closing Ekonews…

Remember, Eko is your go-to source for staying updated on the latest climate news and supporting your journey towards sustainability!

Stay eko-carbonized until next Thursday… 🌱💚

– Eko

Reply